In November, Impact Austin hosted a group of A-List celebrities of the information kind.

When you get people like Libby Doggett, Rich Froeschel, Robert Faires and others in a room, you just know you are going to hear and see something special.

In past years, only the attendees got to hear the presentations, which delve into each of Impact Austin’s focus areas, but this year we got creative (and got permission, of course) to video these for all of you who will be working on the 2015 Focus Area Committees and ultimately voting on a grant winner in each of them.

Click the images below to view recordings from the event. These are not professional, so excuse any lack of audio/video quality, but we think you will enjoy the energy, humor and amazing amount of timely and topical information our guests were able to share with us. Many thanks to our outstanding speakers and the Discovery Day Committee of Impact Austin who worked so tirelessly to make this event a highlight of our year.

Enjoy!

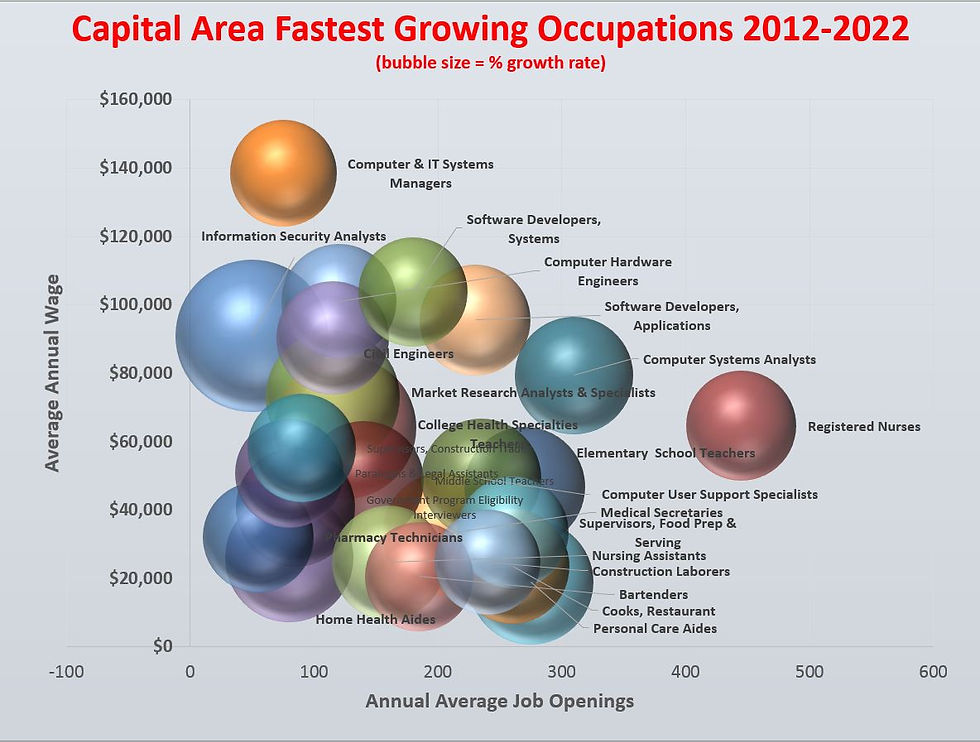

DEMOGRAPHICS: The Overview – “"Will and Skill: Aligning Education and the Texas Labor Market”

Richard Froeschel, Demographer

CULTURE:"Austin's Creative Community for the 21st Century"

Robert Faires, Arts Editor of the Austin Chronicle

EDUCATION:"Early Education in the Spotlight"

Libby Doggett, Ph.D., Deputy Assistant Secretary for Policy and Early Learning, U.S. Department of Education

ENVIRONMENT: "Get the Facts About the Drought"

Bill Lauderback, V.P. for Public Affairs, Lower Colorado River Authority

HEALTH & WELLNESS: "Emerging Trends and Tremendous Opportunities for Health & Wellness"

Lindsey Moseby, Executive Strategy Director, Health at frog